Built from Real Conversations

We started kloraviaent in 2018 after noticing a gap nobody wanted to talk about.

Financial education often feels like learning a foreign language. Complex jargon, unrealistic examples, and advice that doesn't match what everyday people actually face. We kept hearing the same frustrations from friends and family who wanted to manage money better but felt overwhelmed by where to start.

So we built something different. Our programs focus on the practical side—how to track spending without feeling restricted, how to plan for life changes, and how to make financial decisions that actually fit your situation. Not theory for theory's sake.

What Drives Our Work

These aren't corporate buzzwords. They're the principles we come back to when designing every course and updating every resource.

Clear Language

Financial concepts don't need complicated vocabulary to be understood. We explain things like we're talking to a friend over coffee, not presenting to a boardroom.

Real Scenarios

Our examples come from actual situations people face—unexpected car repairs, planning for parental leave, managing irregular income. We skip the unrealistic case studies that assume everyone earns six figures and has no debt. Life is messier than textbooks suggest, and our programs reflect that reality.

Honest Timelines

Financial discipline takes time to build. We don't promise quick fixes or overnight transformations. Most participants see meaningful changes within six to twelve months of consistent application.

How We Structure Learning

Start Where You Are

No judgment about past money decisions. We begin by understanding your current habits and what's already working, then build from there. Some people need help with tracking, others with planning ahead.

Practice with Guidance

Theory alone doesn't create change. Our programs include regular exercises, feedback on your progress, and adjustments when something isn't clicking. Think of it like learning a musical instrument—consistent practice with someone to guide you.

Build Sustainable Habits

We focus on changes you can maintain long-term. Extreme budgets that eliminate all discretionary spending don't last. Better to make smaller adjustments that actually stick.

Who You'll Learn From

Our team brings practical experience from various financial backgrounds. We've all had to learn these skills ourselves—some of us the hard way.

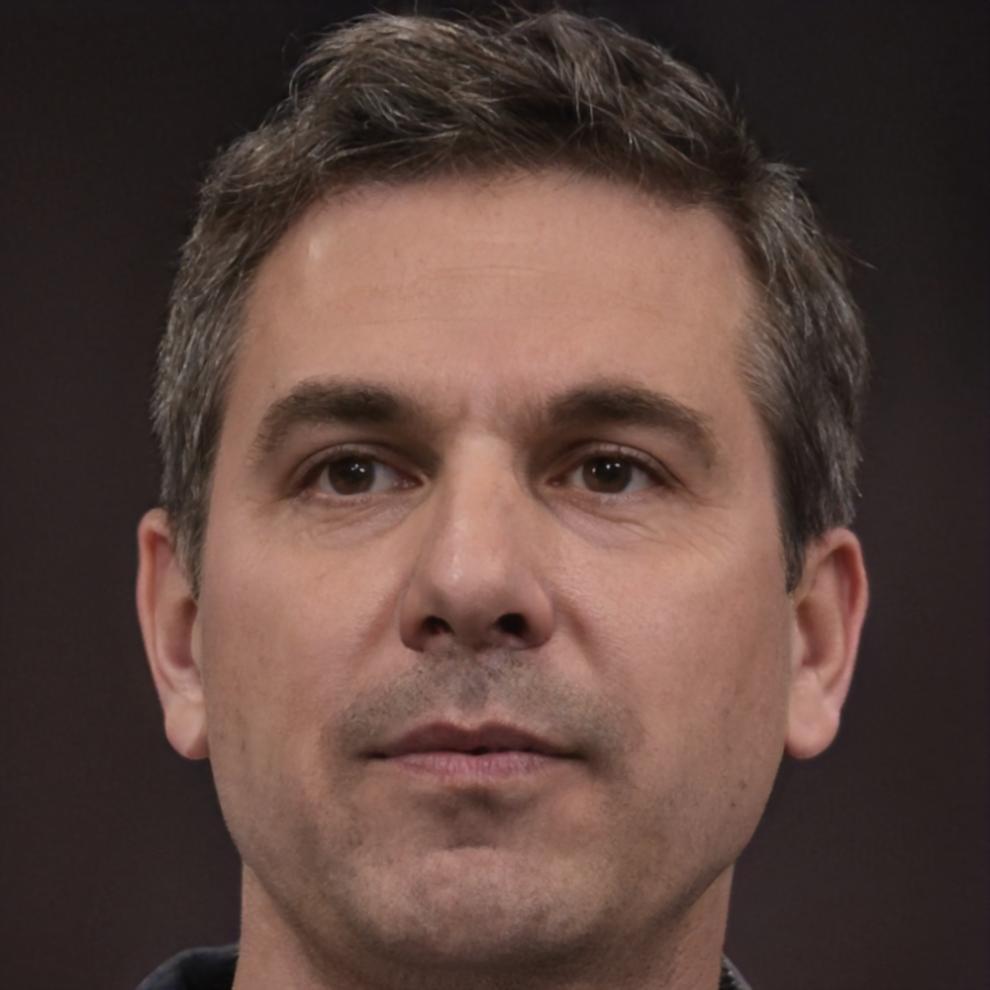

Fletcher Marsh

Head of Financial Education

Fletcher spent eight years as a financial counselor before joining kloraviaent in 2019. He noticed that most people didn't need complex investment strategies—they needed help with the basics. Tracking expenses consistently. Understanding where money was actually going. Planning for predictable costs like car registration.

He designed our core curriculum around the questions he heard most often during those counseling sessions. His background includes a diploma in financial services and ongoing work with community financial literacy programs across regional NSW.

Outside of work, Fletcher volunteers with a local community center teaching basic budgeting workshops. He believes financial skills should be accessible to everyone, regardless of income level or educational background.

Ready to Get Started?

Our next program intake opens in September 2025. We keep groups small to allow for individual attention and meaningful discussion. If you're interested in learning more about our approach or want to chat about whether our programs might fit your situation, reach out.